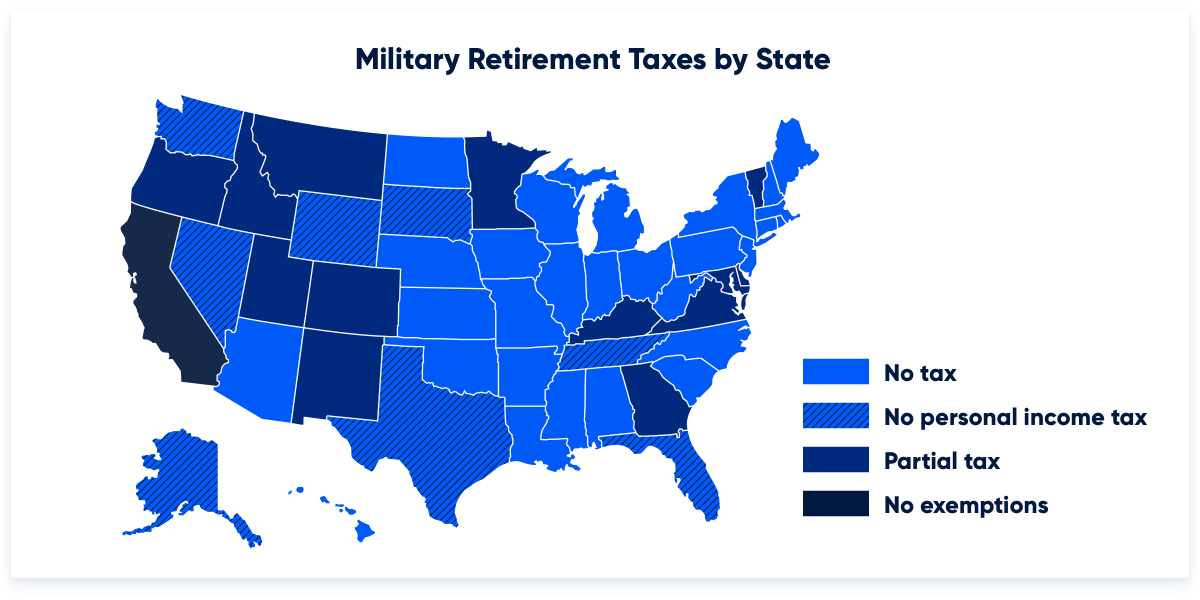

Military retirement is taxable, but whether or not you have to pay it differs depending on the state where you live. As of 2024, California is the only state that taxes military retirement pay at the typical income tax rate.

As Veterans transition into retirement, a crucial question looms large: will your hard-earned military retirement pay be subject to state income taxes?

Service members typically qualify for retirement benefits after serving 20 years of active duty. This retirement system allows service members to receive a pension based on their pay grade and years of service.

To ensure you make the most of your retirement dollars, you should know how income tax will affect it. Income tax exemptions on your military retirement income can potentially save you thousands of dollars annually.

States That Don’t Tax Military Retirement

Some states don’t require income tax at all, while others have unique exemptions for military retirement.

States with No Income Tax

The following 9 states do not tax income and, therefore, do not tax military retirement pay:

- Alaska

- Florida

- Nevada

- New Hampshire – taxes dividend and interest income

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

States With Exemptions For Military Retirement Income

The following states do employ income taxes but have passed special legislation that fully exempts military retirement from income tax. See below for a full list of state policies.

- Alabama

- Arizona

- Arkansas

- Hawaii

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Maine

- Massachusetts

- Michigan

- Mississippi

- Missouri

- Nebraska

- New Jersey

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Pennsylvania

- Rhode Island

- South Carolina

- West Virginia

- Wisconsin

Military Retirement Tax Exemptions by State

Here is a summary of each state's military retirement income tax policies available to qualifying Veterans. To make sure you qualify, be sure to click the link in the state name to see your state's complete tax exemption requirements.

| State | Military Retirement Tax Policy |

| Alabama | Alabama does not tax military retirement pay. |

| Alaska | Alaska does not have personal income tax. |

| Arizona | Arizona does not tax military retirement pay. |

| Arkansas | Arkansas does not tax military retirement pay. |

| California | California fully taxes military retirement pay. Typical California state income tax rates apply. |

| Colorado | Colorado allows an exemption on military income up to $15,000 if you are below 55. If you are age 55 or above, you can exempt up to $24,000. |

| Connecticut | Connecticut does not tax military retirement pay. |

| Delaware | Delaware exempts $2,000 of pensions for those under age 60. If you are 60 and older, you may exempt $12,500 of eligible retirement income, including pensions. |

| District of Columbia | District of Columbia allows an exemption of $3,000 for those 62 and older. |

| Florida | Florida does not have personal income tax. |

| Georgia | Georgia allows retired Veterans below age 62 an exemption of up to $17,500 or above, depending on your income level. Veterans ages 62 to 64 are eligible for an income tax exemption of up to $35,000. Those over 65 are eligible for an exemption of up to $65,000. |

| Hawaii | Hawaii does not tax military retirement pay. |

| Idaho | Idaho allows you to deduct up to $41,140 if you are 65 years and older and you meet eligibility requirements. |

| Illinois | Illinois does not tax military retirement pay. |

| Indiana | Indiana does not tax military retirement pay. |

| Iowa | Iowa does not tax military retirement pay. |

| Kansas | Kansas exempts military retirement from residents’ state income taxes, but out-of-state pensions are fully taxed. |

| Kentucky | Kentucky allows a pension income exclusion of up to $31,110. Excluding more than $31,110 is possible if you meet eligibility requirements. |

| Louisiana | Louisiana does not tax military retirement pay. |

| Maine | Maine does not tax military retirement pay. |

| Maryland | Maryland allows retired military and spouses of retired military under age 55 to deduct $5,000. If you are age 55 and older, you can deduct up to $15,000 of military pension income. |

| Massachusetts | Massachusetts does not tax military retirement pay. |

| Michigan | Michigan does not tax military retirement pay. |

| Minnesota | Minnesota offers a military pension exemption or the ability to claim a credit for past military service. Requirements for each option vary, so make sure you verify your eligibility with the Minnesota Department of Revenue. |

| Mississippi | Mississippi does not tax military retirement pay. |

| Missouri | Missouri does not tax military retirement pay. |

| Montana | Montana allows a partial military retirement pay exemption depending on your income level and other stipulations. Contact the Montana State Department of Revenue to find your individual deduction amount. |

| Nebraska | Nebraska does not tax military retirement pay. |

| Nevada | Nevada does not have personal income tax. |

| New Hampshire | New Hampshire does not tax military retirement pay. |

| New Jersey | New Jersey does not tax military retirement pay. |

| New Mexico | New Mexico exempts $20,000 of retired military income as of 2023. For 2024 through 2026, $30,000 of retired military income is exempt. |

| New York | New York does not tax military retirement pay. |

| North Carolina | North Carolina does not tax military retirement pay. |

| North Dakota | North Dakota does not tax military retirement pay. |

| Ohio | Ohio does not tax military retirement pay. |

| Oklahoma | Oklahoma does not tax military retirement pay. |

| Oregon | Oregon exempts any military retirement income earned before October 1, 1991. Otherwise, military retirement income is taxed at ordinary rates. |

| Pennsylvania | Pennsylvania does not tax military retirement pay. |

| Rhode Island | Rhode Island does not tax military retirement pay. |

| South Carolina | South Carolina does not tax military retirement pay. |

| South Dakota | South Dakota does not have personal income tax. |

| Tennessee | Tennessee does not have personal income tax. |

| Texas | Texas does not have a personal income tax. |

| Utah | Utah offers a Military Retirement Credit. To calculate your specific credit amount, you can multiply your taxable income by 0.0485. You may be eligible for multiple tax credits, but taxable credits may not be combined. For more information, contact the Utah State Tax Commission. |

| Vermont | Vermont allows a $10,000 exemption from military retirement pay if you make less than $50,000. |

| Virginia | Virginia allows a deduction of $20,000 of retired military pay for the 2023 tax year and $20,000 for the 2024 tax year. For 2025 and later, $30,000 of eligible military benefits may be deducted. |

| Washington | Washington does not have personal income tax. |

| West Virginia | West Virginia does not tax military retirement pay. |

| Wisconsin | Wisconsin does not tax military retirement pay. |

| Wyoming | Wyoming does not have personal income tax. |

Is Military Retirement Pay Federally Taxed?

Yes, all military retirement pay is subject to federal taxation based on the individual's applicable personal income tax rate.

Is Military Retirement Taxable if 100% Disabled?

If you are a Veteran retireee who is 100% disabled, you can receive both disability compensation and military retirement pay. Though your disability compensation cannot be taxed, the retirement portion of your income can be taxed depending on the state where you file.

Can Military Retirement Income Be Used on a VA Loan?

Yes, military retirement income can be used to qualify for a VA loan as long as you meet service requirements and financial guidelines set by your lender.

Related Posts

-

2026 VA Disability Calculator With Pay ChartsNew VA disability compensation rates took effect December 1, 2025. See the current VA disability pay chart, and calculate your monthly compensation.

2026 VA Disability Calculator With Pay ChartsNew VA disability compensation rates took effect December 1, 2025. See the current VA disability pay chart, and calculate your monthly compensation. -

Military Age Restrictions: How Old is Too Old to Serve?In general, the Defense Department restricts enlistment to those 35 and younger. Prior enlisted service members can subtract their previous years of service from their age in order to extend eligibility.

Military Age Restrictions: How Old is Too Old to Serve?In general, the Defense Department restricts enlistment to those 35 and younger. Prior enlisted service members can subtract their previous years of service from their age in order to extend eligibility.