FHA and VA loans are both popular choices for homebuyers, but which one is right for you? It all comes down to your unique financial circumstances. Each mortgage type has benefits and features unique to the program.

FHA loans, insured by the Federal Housing Administration, are accessible to the general public. In contrast, VA loans are backed by the Department of Veterans Affairs and available to Veterans, active duty service members and some surviving spouses.

Let’s take a look at how the two mortgage types compare.

FHA vs VA Loan Volume

For 2023, over 753,000 FHA loans were originated compared to slightly over 377,000 VA loans.

Based on the most recently updated HMDA data as of 2024.

Difference Between FHA and VA Loans

Government-backed mortgages are generally more affordable compared to conventional loans and offer appealing terms for first-time homebuyers, low-income borrowers and those with lower credit. While mortgage lenders and banks do the lending, the government insures these loans, lowering the lender's risk and allowing for more flexible requirements.

Below is a table outlining the essential factors when comparing VA loans to conventional loans.

| Comparison Factor | FHA Loan | VA Loan |

|---|---|---|

| Eligibility | Available to the general public | Only available to active-duty service members, Veterans, members of the National Guard or Reserves and surviving spouses |

| Down Payment | At least 3.5%, but depends on credit score | $0 |

| Credit Score Minimum | 500 to 579 with a minimum down payment of 10% or at least 580 with a 3.5% down payment | None set by VA, but lenders often require at least 620 |

| Interest Rates | Slightly higher than VA | Slightly lower than FHA |

| Property Requirements | Must be primary residence and meet FHA Minimum Property Standards | Must be primary residence and meet VA Minimum Property Requirements |

| Debt-to-Income Ratio | Up to 50% | Up to 41% |

| Loan Limits | $498,257 in low-cost counties to $1,149,825 in high-cost counties. | None if the borrower has full entitlement |

| Mortgage Insurance and Fees | An upfront premium and annual premium | VA funding fee |

Eligibility

A major difference between FHA and VA loans is who is eligible for the loan. FHA loans are accessible to all qualified borrowers, which is particularly beneficial for first-time homebuyers or those with lower credit scores.

On the other hand, VA loans are specifically designed for military service members, Veterans and eligible surviving spouses. Eligibility criteria for VA loans are centered around service requirements, while FHA loans focus on financial and creditworthiness benchmarks.

Takeaway

If you are a Veteran or active-duty service member, it’s probably best to use your VA home loan benefit.

Down Payment

FHA loans are available to the broader public and typically require a minimum down payment of 3.5% if the borrower has a credit score of 580 or higher. Those with credit scores between 500 and 579 are required to make a 10% down payment.

There’s no down payment requirement with a VA loan, meaning you don’t have to put any money down if you have your full VA entitlement. This is a huge benefit of the program and enables individuals to finance 100% of the home's value.

Takeaway

Choose a VA loan if you don’t have enough saved for a down payment.

Credit Score Requirements

FHA loans typically have a minimum credit score requirement of around 580, but that can vary by lender. Borrowers with a score below this threshold may still qualify but might be required to make a larger down payment.

VA loans are more lenient in terms of credit score and don’t have a strict minimum credit score requirement. The loan approval is more dependent on the lender’s discretion. VA lenders often look at the overall credit profile rather than focusing solely on the credit score. A common benchmark is a credit score of 620, but this may vary by lender.

Takeaway

If your credit score is below 620 and you can afford a down payment, a FHA loan is probably the best bet.

Interest Rates

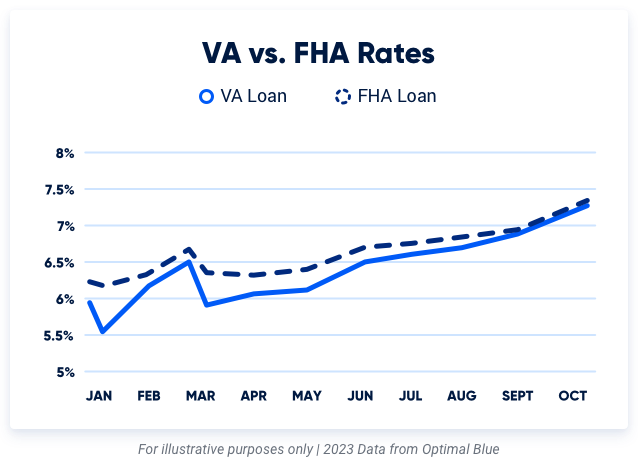

Since VA and FHA loans are both government-backed, they can offer more favorable interest rates. According to Optimal Blue, VA loan rates remained .226 percent lower on average than FHA in 2023.

Let’s break down the monthly payments and total interest paid for both types of loans, assuming a loan amount of $200,000 over a 30-year period with a .226 difference interest rate.

Comparing VA and FHA Loan Total Interest

| Loan Type | Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|---|

| VA Loan | 6.376% | $1,287.13 | $263,363.01 |

| FHA Loan | 6.602% | $1,321.07 | $275,584.70 |

Note: This is a simplified calculation and actual savings may vary based on various other factors like loan amount, fees, insurance and other factors.

In this scenario, choosing a VA loan results in interest savings of $12,222 over the duration of the loan. While FHA interest rates are usually low, a .226 percent difference in rate when compared to VA loan interest rates can equal thousands in interest savings over the life of the mortgage.

Takeaway

Over the last year, VA interest rates were slightly lower than FHA. However, interest rates largely depend on your financial situation.

Property Requirements

FHA and VA loans are intended for primary residences, requiring borrowers to occupy the home.

FHA loans have specific property standards to ensure the safety, security and soundness of the property. This includes requirements related to the home’s structural integrity and electrical, heating or plumbing systems. FHA loans do require an appraisal before financing the loan.

VA loans have similar property requirements, ensuring the home is safe, sanitary and structurally sound for military Veterans and their families. VA loans also mandate an appraisal to ascertain the home's value and condition, with a keen eye on particular Minimum Property Requirements (MPRs).

Takeaway

Both FHA and VA loans require appraisals to meet property requirements and must be the borrower’s primary residence.

Debt-to-Income Ratio

The debt-to-income (DTI) ratio represents the proportion of your gross monthly earnings that is used to pay off debts, including the mortgage payment.

The maximum DTI ratio for FHA loans is generally 50%. However, there may be exceptions, allowing for higher DTI with compensating factors.

The VA doesn’t set a maximum DTI ratio. However, borrowers exceeding a ratio of 41% are subject to an in-depth assessment to ensure their residual income is sufficient to manage living costs after making mortgage or other debt payments.

Takeaway

If you have a DTI ratio greater than 41%, you may have an easier time getting approved with a FHA loan.

Loan Limits

FHA loan limits are capped and vary depending on the county and state where the property is located. These limits are set to ensure that the program caters to low to moderate-income homebuyers. FHA loan limits are slightly more constricting, with a common maximum borrowing amount of $498,257.

VA loans do not have a maximum loan limit if you have your full VA entitlement. However, limits may still apply to those who have previously used the VA loan benefit or have diminished VA entitlement.

Takeaway

A VA loan usually offers more flexibility than an FHA loan if you have your full VA entitlement.

Mortgage Insurance and Fees

FHA loans come with two mortgage insurance charges – an upfront insurance premium and a yearly mortgage insurance premium (MIP) based on the remaining loan balance. The one-time upfront charge on FHA loans is 1.75% of the loan amount and is added to your loan balance. The annual premium decreased from 0.85% to 0.55% of the loan amount in early 2023, saving FHA buyers potentially thousands over the life of the loan. The annual MIP can only be canceled once your mortgage is paid in full unless you had a down payment of at least 10%. In that case, the MIP will be canceled after 11 years.

In the case of the VA, the funding fee varies from 1.25% to 3.3% of the loan amount, depending on the down payment amount and previous VA loan use. This fee can be paid upfront or rolled into the total loan amount. Some VA loan applicants are exempt from paying the funding fee and may waive the fee altogether.

For a FHA loan of $250,000, the total amount financed would be around $254,375 with an additional MIP annual fee. The overall additional cost from the annual premium would be around $30,000-$35,000 by the end of the loan, depending on the amortization schedule.

For a VA loan of $250,000, the total amount financed would be $255,750 with no annual fee. While the VA funding fee can be a greater upfront cost, it is much more cost-effective over the life of the loan.

Takeaway

VA loans may be more cost-effective in the long run. It's important to calculate the total costs over the life of the loan.

» CALCULATE: Calculate your VA Loan savings

Are FHA loans better than VA loans?

Deciding if a FHA or VA home loan is better depends on your situation and needs.

A VA loan might be the best option if you want to avoid loan limits or don’t have funds saved for a down payment. Although there is a one-time VA funding fee, you may qualify for an exemption, which isn’t possible for FHA program fees.

A FHA loan may be a better option if you have a lower credit score or a higher DTI ratio. These loans have lower credit requirements, making them ideal for first-time homebuyers.

No matter what your homebuying goals are, Veterans United is here to help. Talk with a home loan expert to get a complete comparison for your unique homebuying journey.

Related Posts

-

Can Your Mortgage Be Denied After Preapproval?It is possible for you to get denied for a home loan after being preapproved. Find out why this may happen and what you can do to prevent it.

Can Your Mortgage Be Denied After Preapproval?It is possible for you to get denied for a home loan after being preapproved. Find out why this may happen and what you can do to prevent it. -

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them.

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them.